Graph data is for illustrative objectives only and also undergoes alter without notice. Marketed price, factors as well as APR are based upon a collection of loan presumptions. Chart precision is not assured and products may not be offered for your situation. Monthly payments shown include principal and rate of interest only, and, any kind of required mortgage insurance coverage. Any type of various other fees such as property tax as well as home owners insurance policy are not included and will lead to a greater actual regular monthly payment. Marketed car loans assume escrow accounts unless you ask for or else and also the car loan program and suitable legislation allows.

You recognize that you are not required to grant getting autodialed calls/texts as a condition of buying any kind of Bank of America service or products. Any cellular/mobile telephone number you offer might sustain costs from your mobile provider. Your lender will tackle added risk when they authorize your FHA finance and also will need to make up for that uncertainty by needing home mortgage insurance coverage. While an FHA finance structure trims down some standard home loan challenges, this kind of financing does include some included costs that every applicant should know.

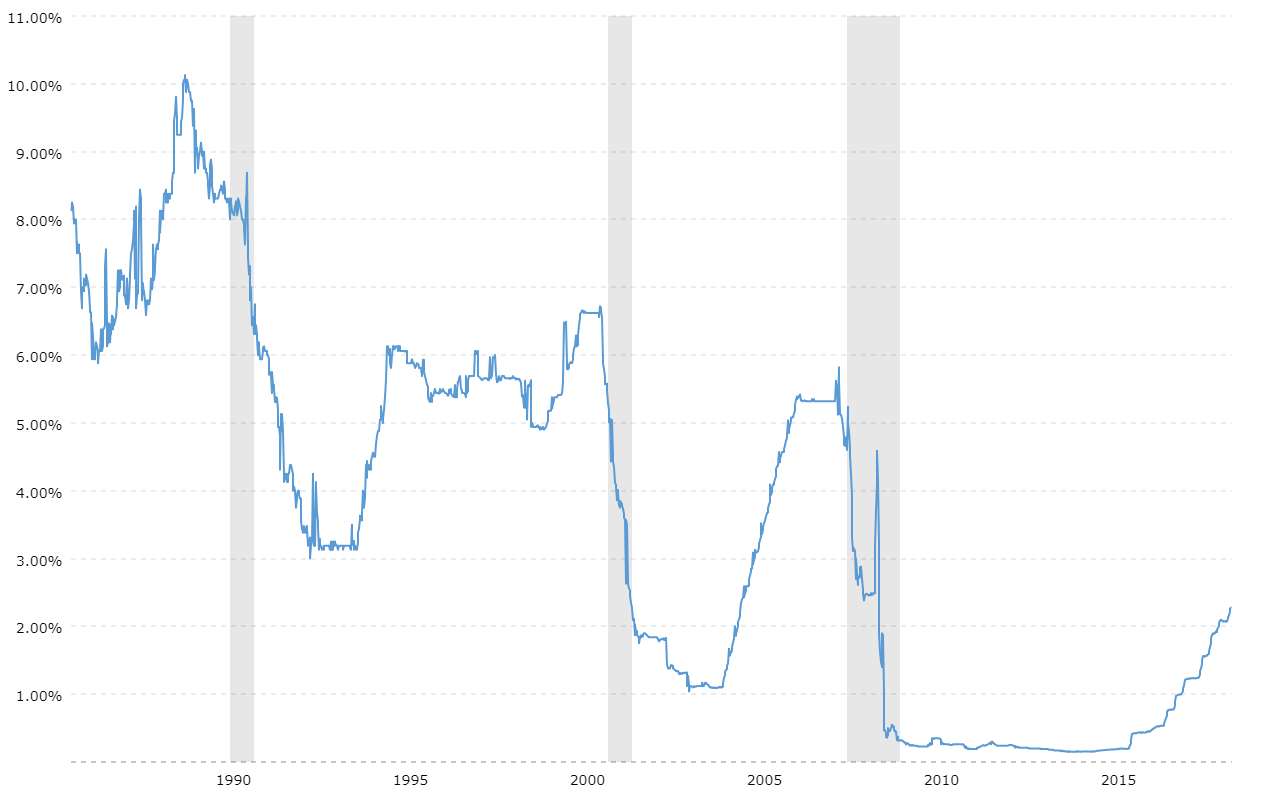

- Usually, home loan rates of interest move separately and ahead of the federal funds price, or the amount financial institutions pay to obtain.

- Some FHA mortgage loan providers allow credit scores as reduced as 500, though a greater rating will reduce your down payment demand.

- The minimum you'll require to put down will certainly depend on the kind of home mortgage.

Detailed rates are supplied solely through Rocket Home loan. To see an updated checklist of adhering limits, visit our adapting car loan limitations page. For a complete list of 2022 FHA car loan limitations, see the chart below.

Fixed

The actual rates of interest you can get may be various from the ordinary prices priced estimate in our rate table. A Federal Housing Management financing is a government-backed residence mortgage funding with more versatile borrowing demands than conventional finances. Because of this, FHA home http://keeganzvxm074.lucialpiazzale.com/contrast-today-s-current-mortgage-rates mortgage interest rates might be rather higher. The buyer will also have to pay regular monthly home mortgage insurance costs, together with their monthly funding settlements. The 30-year set rate mortgage is one of the most usual sort of home mortgage, however there are extra home mortgage options that may be much more valuable depending on your scenario. Considered that ARM fundings vary, the interest rate might wind up being greater than with a 30-year fixed price home loan that has a locked-in home mortgage rate.

After that assess the Origination Charges situated on the Lending Estimate under Car loan Costs to see just how much the loan provider is butting in fees. The greater the charges and also APR, the a lot more the loan provider is crediting acquire the funding. The remaining costs are typically suitable to all lending institutions, as they are determined by solutions and also plans the customer picks, along with regional tax obligations and federal government charges. Remember that home loan prices may transform daily as well as this information is planned to be for educational functions just. A person's individual credit score and earnings account will certainly be the determining consider what loan rates as well as terms they are able to get. wesley financial timeshare Funding prices do not include quantities for taxes or insurance premiums as well as specific lender terms will use.

Exactly How To Purchase Mortgage Prices

" We're not expecting an over night skyrocket", claims Ali Wolf, chief financial expert at Zonda, a California-based housing data and consultancy firm. Below is everything you need to know about scoring the best price as well as how much it can save you. Try a contrast price website, or request a reference from a close friend, member of the family or a realty agent. Division of Housing and Urban Advancement's Lending institution List Search tool.

The rate difference in between the highest as well as most affordable rates lenders use you could be as high as 0.75%, according to a record by the fintech start-up Haus. On Monday, January 03, 2022, according to Bankrate's most recent survey of the country's biggest mortgage lenders, the typical 30-year set home mortgage rate is 3.270% with an APR of 3.410%. The ordinary 15-year fixed mortgage price is 2.540% with an APR of 2.760%.

Flexible Rate Mortgage

Home Mortgage Insurance Costs is needed for all FHA loans and also Exclusive Great post to read Home loan Insurance is required for all conventional lendings where the LTV is more than 80%. To approximate your month-to-month mortgage settlement, you can use a home mortgage calculator. It will supply you with an estimate of your month-to-month principal and rate of interest payment based upon your rates of interest, deposit, acquisition rate and other elements. The minimum you'll need to put down will certainly depend on the kind of home mortgage.

Numerous customers may be qualified for rock-bottom prices, only to have potential financial savings gotten rid of by the need to pay more to get a deal approved. Some specialists see signs that home prices are starting to cool down, ever so slightly. They are most likely to continue to boost, just at a slower rate.

A source cost is what the loan provider bills the borrower for making the mortgage. The fee may include refining the application, underwriting and funding the car loan as well as other management services. Source fees normally do not raise unless under certain scenarios, such as if you choose to opt for a different type of car loan. The table below is upgraded daily with present mortgage rates for the most typical sorts of home loans. Readjust the chart below to see historic mortgage prices customized to your lending program, credit history, deposit and also location. While guidelines have actually altered over time, MIP is needed for the entire life of a 30-year FHA loan.